Network with Coke Scholars Connect

With Coke Scholars Connect, Scholars and alumni can log in with LinkedIn, Facebook, or email, and in just a minute, network with 6,450+ of their fellow change agents.

The Latest

Upcoming Events

2021-22 Coke Scholars Application Opens

2021-22 Coke Scholars Application Closes

Giving Back

How Can I Support the Foundation?

Your donation does good: supporting new programs for our ever-growing Scholar and alumni network around the world, providing service, mentorship, leadership development, networking and lifelong enrichment opportunities. But more importantly, our future is up to you, Scholar, as your continued involvement shapes the potential of our alumni community.

There are so many ways to give back. Choose the one right for you, and know that you have our gratitude.

Thank you!

Your gift to the Coca-Cola Scholars Legacy Fund helps support enrichment opportunities and programming for the alumni community—over 5,850 leaders and growing every year.

We also welcome your choice to make an unrestricted gift to our General Fund. All individual gifts to the Coca-Cola Scholars Foundation, a 501©3 nonprofit organization, are tax deductible.

Have questions or feedback? Call us at 800-306-2653.

Get stuff. Give smiles.

An extremely easy way to show your support for Coca-Cola Scholars: link your Amazon account with our organization. Click, and Amazon will donate .5% of the cost of eligible AmazonSmile purchases to the Foundation.

Best Night of the Year

As you likely remember, Scholars Weekend, which features our Scholars Banquet, is one of the highlights of our year. A pledge from your company can help us continue to make it an experience Scholars will never forget.

Contact Ericia Ward-Williams to become a sponsor.

Sharing is Caring

If you give to the Coca-Cola Scholars Legacy Fund, you’ll enjoy an income tax benefit. But you may also receive another tax advantage if you use appreciated stock; the capital gains tax on the appreciation of in market value is essentially waived.

Making a gift of stock from your investment account is easy. Just instruct your broker to transfer the shares to CCSF for the benefit of the Coca-Cola Scholars Legacy Fund.

Please contact LaQuanda Prince at the Coca-Cola Scholars Foundation for more information on transferring shares in the form of certificates, and to let us know that your gift is in process. Many times, transfers are made without a name attached, and we’d like to match your name with your gift. We’ll use the date that the shares enter CCSF’s account as your gift date, and credit you with the average market value on that date.

Retirement or Remainder Trust

You may consider using retirement plan assets (IRAs, 401(k) Plans, Profit Sharing Plans, Keough Plans, and 403(b) Annuity Plans) to make a significant and meaningful gift that will support the Program into the new millennium and beyond. And, because of the estate and income tax treatment of retirement plan assets, the “cost” of the gift to your estate and heirs is often relatively small.

Naming the Coca-Cola Scholars Legacy Fund as a beneficiary of your retirement plan account is one of the easiest ways to make a planned gift, and in many ways is similar to making a bequest. Simply call your plan administrator and request a Change of Beneficiary form. In the beneficiary section, list ‘Coca-Cola Scholars Legacy Fund’ (Tax ID Number: 58-1686023) as the primary beneficiary for all or a portion of the account. Then return the form to your plan administrator and send a copy to us for our records.

Another Alternative: Retirement Plan Assets and Testamentary Charitable Remainder Trusts

A charitable remainder trust funded with retirement plan assets is a great way to reduce estate taxes, provide a lifetime income stream to one or more beneficiaries, and to make a charitable gift — all at the same time. They provide income to one or more beneficiaries for life with the remainder interest going to charity upon the death of the income beneficiaries.

The decedent’s estate receives an estate tax deduction for the present value of the Foundation’s interest in the retirement plan assets. The trust itself is tax-exempt so no income taxes will be due when the retirement plan assets are received by the Trustee. When the trust terminates, the remaining assets will be paid to the Coca-Cola Scholars Foundation and used for the Coca-Cola Scholars Program.

Please Note:

This information is not intended to be considered legal or tax advice. For advice regarding all matters associated with charitable giving, please consult an attorney and/or a professional tax advisor.

Give Multitudes

Matching gifts can double or triple your support. So, if you work for a company that matches charitable gifts, we’d love it if you obtain a matching gift form from your personnel office and send it along with your contribution.

Give Time & Talent

Help Select our Scholars

Alumni play an important role in selecting future Coke Scholars. Many with higher education, high school and college counseling, or university admissions backgrounds read applications during our Semifinalist stage. Alumni also participate in regional interviews during our final round of selection.

If you are a previous recipient of our scholarship and have read applications before, interviewed others for scholarships or fellowships, or have a background in higher education or counseling, we may want to add you to the list of alumni to be considered for a future committee. If you are interested in this opportunity, contact Jamie Williams.

Host an Alumni Event

Scholars do even better things together. With that in mind, we would love for you to host a career development, networking, or social event for Coca-Cola Scholars in your area. Let Carolyn Norton know if you have an idea.

Give Talent

Do you take beautiful pictures, write engaging stories, or have another special skill that could help CCSF further our mission? Let us know – we’d love your help.

Help Develop our Scholars

A group of 30 alumni come to Scholars Weekend each year to serve as facilitators for our Leadership Development Institute. If you are at least five years out of college and have experience facilitating small groups, coaching young adults, or other leadership expertise, you may be a great fit as a LDI facilitator or coach in our pilot coaching program. If interested in either opportunity, contact Jamie Williams.

Leave a Legacy

A bequest is a gift of any amount made to the Coca-Cola Scholars Legacy Fund in your will. You may include a charitable bequest when you execute a new will, or you can add it to an existing will through a codicil.

In addition to giving you the satisfaction of providing for the future of the Coca-Cola Scholars Program, a charitable bequest usually provides large tax savings. Because the gift is deductible from your adjusted gross estate, it may reduce or eliminate estate taxes.

Bequests can take various forms, and we describe each below and provide sample language for you to consider.

Specific Bequests

A specific bequest states a specific amount or specific asset. It may be a gift of cash, securities, real estate, or tangible personal property. Example:

I give [the sum of _____________ Dollars ($________)] to the Coca-Cola Scholars Legacy Fund (Tax ID# 58-1686023), located in Atlanta, Georgia. The Board of Directors of the Fund and the Alumni Advisory Board of the Coca-Cola Scholars Program shall treat this bequest as part of its Legacy Fund, and the income shall be used for the unrestricted needs of the Coca-Cola Scholars Program.

Residuary Bequests

Names the Coca-Cola Scholars Legacy Fund to receive all or a percentage of the remainder of the estate after specific bequests have been fulfilled. Example:

I give [____ percent] or [the remainder] of my residual estate to the Coca-Cola Scholars Legacy Fund (Tax ID# 58-1686023) for the unrestricted needs of the Coca-Cola Scholars Program.

Contingent Bequests

Takes effect only if all primary beneficiaries named in the will predecease you. Declaring the Coca-Cola Scholars Legacy Fund a contingent beneficiary can prevent the property from going to the state if there are no heirs. Example:

If [name of beneficiary] predeceases me, I give such property to the Coca-Cola Scholars Legacy Fund (Tax ID# 58-1686023) for the unrestricted needs of the Coca-Cola Scholars Program.

Testamentary Trust

With a testamentary trust, you direct that part or all of your estate is left in a charitable remainder trust, with income to be paid to one or more beneficiaries. Upon the death of the surviving beneficiary, the principal will be transferred to the Coca-Cola Scholars Legacy Fund to be used as you designate. A testamentary trust is particularly attractive to someone who wishes to provide income for a spouse or other relative but wants the remainder to come to the Coca-Cola Scholars Legacy Fund. In addition, this type of gift frequently produces tax advantages.

Documentation

In order to recognize you as a Coca-Cola Scholars Legacy Donor, please provide the Foundation with some simple documentation of the provision in your will or living trust. That documentation might consist of a letter or a copy of the portion of your estate document that refers to your designation to the Coca-Cola Scholars Legacy Fund/Coca-Cola Scholars Foundation.

Your planned gift in support of the Coca-Cola Scholars Legacy Fund is also a gift to the Coca-Cola Scholars Foundation. Every gift is deeply appreciated and carefully stewarded. If you prefer, we will keep your name confidential.

Naming the Coca-Cola Scholars Legacy Fund as a beneficiary of your retirement plan account is one of the easiest ways to make a planned gift, and in many ways is similar to making a bequest. Simply call your plan administrator and request a Change of Beneficiary form. In the beneficiary section, list ‘Coca-Cola Scholars Legacy Fund’ (Tax ID Number: 58-1686023) as the primary beneficiary for all or a portion of the account. Then return the form to your plan administrator and send a copy to us for our records.

Another Alternative: Retirement Plan Assets and Testamentary Charitable Remainder Trusts

A charitable remainder trust funded with retirement plan assets is a great way to reduce estate taxes, provide a lifetime income stream to one or more beneficiaries, and to make a charitable gift—all at the same time. They provide income to one or more beneficiaries for life with the remainder interest going to charity upon the death of the income beneficiaries.

The decedent’s estate receives an estate tax deduction for the present value of the Foundation’s interest in the retirement plan assets. The trust itself is tax-exempt so no income taxes will be due when the retirement plan assets are received by the Trustee. When the trust terminates, the remaining assets will be paid to the Coca-Cola Scholars Foundation and used for the Coca-Cola Scholars Program.

Please Note:

This information is not intended to be considered legal or tax advice. For advice regarding all matters associated with charitable giving, please consult an attorney and/or a professional tax advisor.

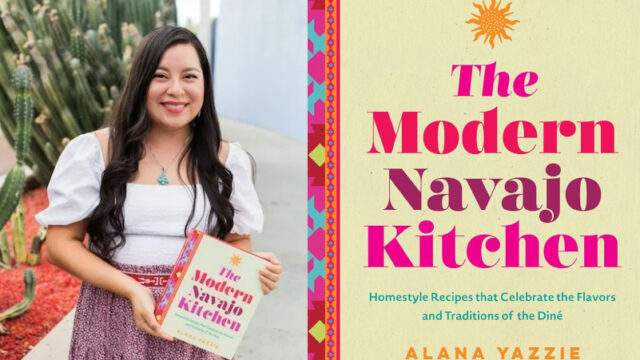

Share Your Story

So, what have you been up to? Posting with the #cokescholars hashtag lets us—and your fellow Scholars—stay informed with what’s going on with our illustrious alumni. Tell us about what you’re working on, what you’re participating in, where you’re headed and with whom you’re collaborating.

Join our Alumni Facebook Group

You’ll find the Coca-Cola Scholars alumni community in every corner of the world. The Alumni Facebook Group is where we come together, to share updates and post career opportunities, share our triumphs and ask for assistance from our brother and sister Scholars. Join us!